SEB Simplifies International Transfers with SWIFT and BIC Codes

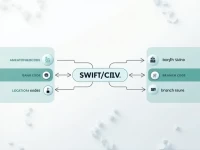

This article discusses the SWIFT/BIC code ESSESESSCAL of SKANDINAVISKA ENSKILDA BANKEN AB, covering its structure and usage. It emphasizes the importance of ensuring the accuracy of the code in international remittances and recommends the professional remittance service Xe to enhance the efficiency and security of the remittance process.